Venture Capital Trusts

A brief history of VCTs

Venture Capital Trusts, or VCTs for short have been around since 1995. They are an established investment, and continue to be be supported by the Government. They’re not “dodgy” tax evasion schemes. Click here to find out more about Venture Capital Trusts.

The reason there is still government support for VCTs is that they create more tax for the Government, than investors actually save.

The small companies it invests in should hopefully grow, and take on more and more staff. These staff will pay tax and National Insurance, and the company would normally pay corporation tax on its profits.

A VCT has to follow certain rules and have to seek HMRC approval too. See what the GOV.uk says about VCTs.

Investor tax benefits

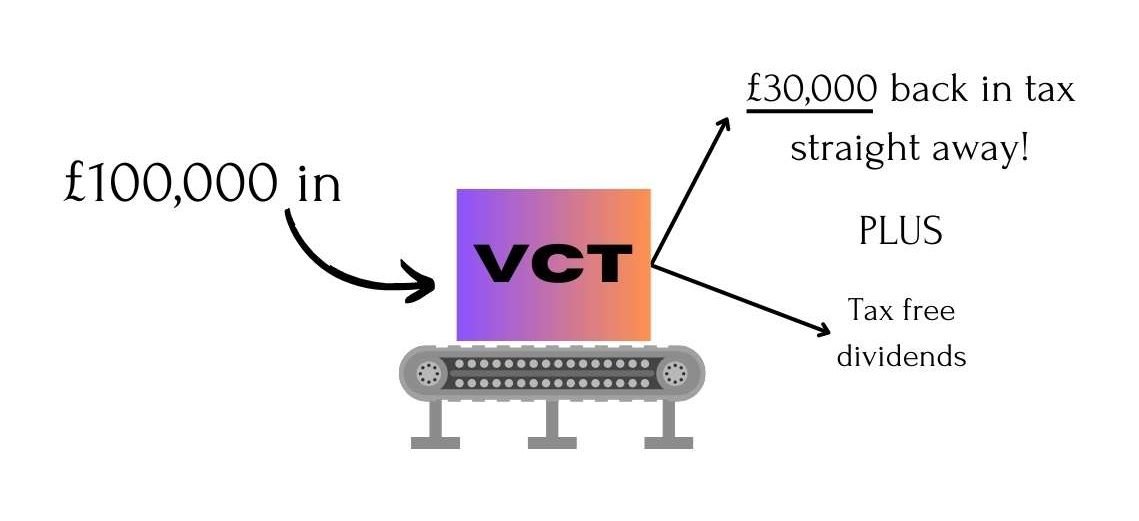

There are a number of tax advantages of investing in a VCT, you get 30% of your investment as tax relief.

Though the tax you save on the contribution is limited to the amount of income tax you pay.

The maximum you can pay into a VCT is £200,000 per year, giving a yearly maximum income tax saving of £60,000. (£50,000 invested would give a tax saving of £15,000)

It can only reduce the tax you pay to zero.

Call us today on 01793 686393 to find out more!

With a VCT any profits paid out as a dividend by the VCT would be tax free.

A higher rate tax payer would normally pay £640 in tax on a £1,600 dividend, leaving just £1,000. A dividend of £1,600 from a VCT would mean £1,600 in your pocket, as there would be no income tax to pay.

Suppose you invested £100,000 in a VCT and it was giving a yield of 4.5%, this would be £4,500 per year.

But, for a higher rate tax payer, this would be the equivalent of receiving a £7,200 “normal” dividend for shares before tax.

If you decided to sell your shares in the VCT, provided you have held them for five years, and the VCT has maintained its VCT status (it has not broken the rules), then any gain is free of tax capital gains tax too.

In a nutshell the tax benefits of a VCT are:

-

30% tax relief on contributions (30p off your income tax for every £1 invested)

-

it can reduce your tax bill to zero

-

the maximum year contribution is £200,000 – giving a maximum yearly tax saving of £60,000

-

dividends (profit) paid out are tax free

-

there is no Capital Gains Tax to pay if you sell your VCT shares

It's not all about tax

A VCT is not, and should not be used solely for its tax benefits. It is an investment with the aim of making money work too. The tax-relief does give you some instant benefits that is true. But you should not forget about the the potential returns and potential risks.

There are many well known companies, which are household names, that have received VCT investment such as:

- Zoopla

- Secret Escapes

- graze.com

- Depop

- Many Pets

- Cinch

But there will have been many companies which will have gone out of business too. In a well spread VCT this would have less problems, as it would be hoped that the other companies would have done better.

Speak to an expert

If you want to find out more about VCTs and how they can work for you, what are the risks and advantages then get in touch with us on 01793 686393.

We can help you through the process of deciding if a VCT is right for you and which VCT is right. You might just have a question or query, and we can help with that too.

We are independent financial advisers and have access to the entire VCT market, and other products too.

Click here to find out more.

If you have a question about reducing your tax or want advice, or just want to have a chat about it with a UK qualified independent financial adviser, then phone now on 01793 686393, or alternatively you can contact us online.